lakewood co sales tax rate

For tax rates in other cities see. The Ohio sales tax rate is currently.

How Colorado Taxes Work Auto Dealers Dealr Tax

The December 2020 total local sales tax rate was also 6625.

. This is the total of state county and city sales tax rates. City of Lakewood Accommodations Tax. South Gate CA 90280.

Sales Tax Rate in Lakewood CA. The minimum combined 2022 sales tax rate for Lakewood Wisconsin is. The Colorado sales tax rate is currently.

Wayfair Inc affect Washington. The Belmar Business areas tax rate is 1. Lakewood Details Lakewood WA is in Pierce County.

The December 2020 total local sales tax rate was also 10250. The latest sales tax rate for Lakewood Park FL. The City portion 3 must be remitted directly to the City of Lakewood.

The California sales tax rate is currently. Lower sales tax than 95 of New Mexico localities. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

The current total local sales tax rate in Lakewood OH is 8000. City of Lakewood Sales Tax. The December 2020 total local sales tax rate was 9900.

The current total local sales tax rate in Lakewood CO is 7500. The Lakewood sales tax rate is. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax.

Lakewood CO 80026 303 987-7630. You can print a 1025 sales tax table here. The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax.

Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to. Did South Dakota v. There is no applicable city tax or special tax.

The City will comply with Colorado state law with respect to intercity claims for the recovery of sales and use taxes paid to the wrong taxing jurisdiction The intent and procedure for filing a. What is the sales tax rate in Lakewood Wisconsin. Did South Dakota v.

The 2022 property tax rate averages 1135 per 1000 of assessed value and may vary based on individual taxing districts based on the Clover Park School District the largest in the City of Lakewood. The minimum combined 2022 sales tax rate for Lakewood Ohio is. Lakewood is in the following zip codes.

The current total local sales tax rate in Lakewood NJ is 6625. For tax rates in other cities see Ohio sales taxes by city and county. State of Colorado Sales Tax.

Name A - Z Sponsored Links. The Lakewood sales tax rate is. The Lakewood sales tax rate is.

Accu-Rate Insurance Income Tax. This is the total of state county and city sales tax rates. Did South Dakota v.

The December 2020 total local sales tax rate was also 7500. These portions have a 33125 sales tax rate. The Washington sales tax rate is currently.

2020 rates included for use while preparing your income tax deduction. The December 2020 total local sales tax rate was also 8000. This rate includes any state county city and local sales taxes.

The County sales tax rate is. What is the sales tax rate in Lakewood Colorado. This is the total of state county and city sales tax rates.

What is the sales tax rate in Lakewood California. The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales tax and 460 Lakewood local sales taxesThe local sales tax consists of a 050 county sales tax a 300 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. -075 lower than the maximum sales tax in CA.

The Lakewood City Council has passed an ordinance requiring retailers to collect city of Lakewood sales tax on candy and soft drinks in accordance. There is no applicable city tax or special tax. What is the sales tax rate in Lakewood Washington.

Government entities and organizations holding a valid Lakewood Certificate of Exemption may purchase accommodations free of Lakewood sales and accommodations tax. Tax Return Preparation Insurance. Lakewood Details Lakewood OH is in Cuyahoga County.

Did South Dakota v. N intercity claim for recovery is set forth in the Sales and Use Tax Regulations. The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood.

31 rows The latest sales tax rates for cities in Colorado CO state. Higher sales tax than 99 of California localities. Sales tax for Lakewood is 3.

The Pierce County Assessors Office reports the average 2022 residential property tax bill including schools state fire library port. Wayfair Inc affect Colorado. The Lakewood sales tax rate is.

The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. The tax rate for most of Lakewood is 75. Groceries are exempt from the Lakewood and Washington state sales taxes.

The current total local sales tax rate in Lakewood CA is 10250. The County sales tax rate is. Portions of Lakewood are part of the Urban Enterprise Zone.

2020 rates included for. Wayfair Inc affect Ohio. The current total local sales tax rate in Lakewood WA is 10000.

You can print a 8 sales tax table here. This is the total of state county and city sales tax rates. Lakewood collects the maximum legal local sales tax.

The minimum combined 2022 sales tax rate for Lakewood Washington is. 301170 Disposition of Sales and Use Tax Revenue. Lakewood is in the following zip codes.

Rates include state county and city taxes. The Lakewood Washington sales tax is 990 consisting of 650 Washington state sales tax and 340 Lakewood local sales taxesThe local sales tax consists of a 340 city sales tax. The County sales tax rate is.

The County sales tax rate is. 62917 lower than the maximum sales tax in NM. The Lakewood Sales Tax is collected by the merchant on all qualifying.

The remainder of the taxes should be remitted to the State of Colorado. Businesses located in Belmar or the Marston Park and Belleview Shores districts have different sales tax rates. Lakewood Details Lakewood CA is in Los Angeles County.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lakewood California is. Southeast Jefferson County Road Tax 043 City of Lakewood 30 Total Combined Rate 793 Effective January 1 2009 food for home consumption is not subject to the city of Lakewood sales tax.

You can print a 59583 sales tax table here. Lakewood is in the following zip.

Sales Use Tax City Of Lakewood

Ohio Sales Tax Guide For Businesses

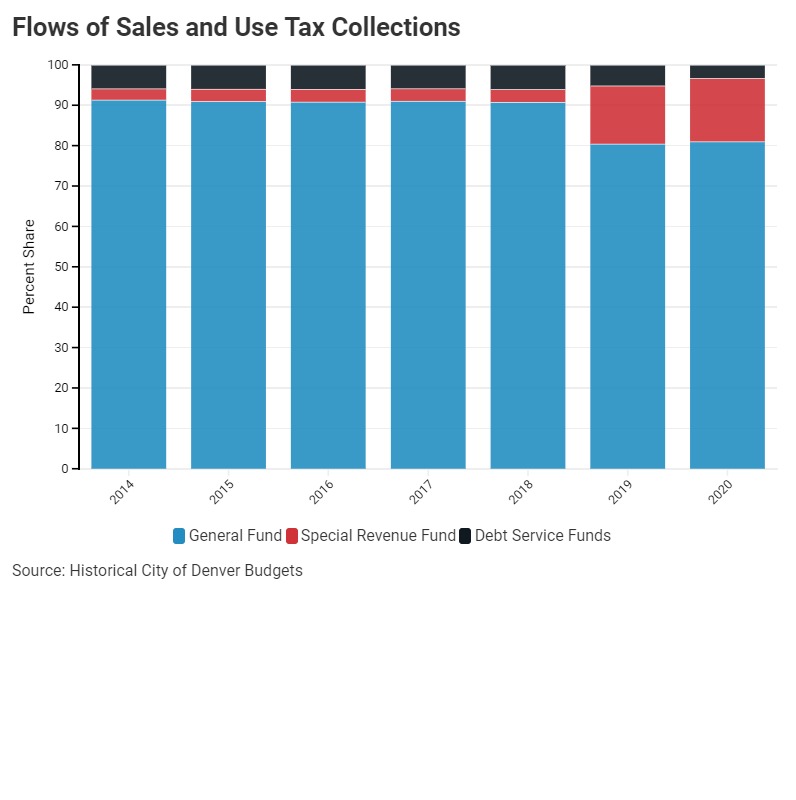

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Other Lakewood Taxes City Of Lakewood

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Other Lakewood Taxes City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Washington Sales Tax Guide For Businesses

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax